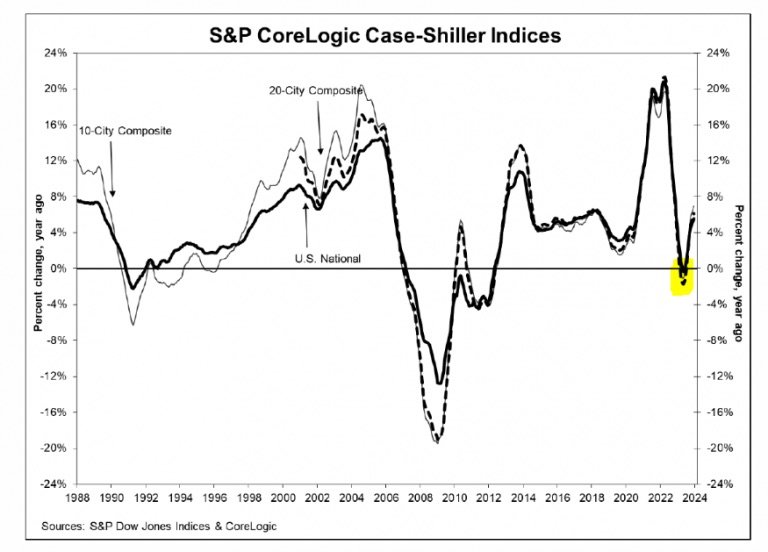

The Housing Market's Inflection Point is Apparent

S&P/Case-Shiller released their Home Price Index on February 27, 2024, published as of December 2023, revealing some valuable insights into last year’s real estate market. Most notably, all 20 markets have now posted positive year-over-year gains, including Portland, which was dragging behind the national trend. Also, half the markets have posted all-time highs in the US with the national housing price gains exceeding the historic averages and indication these gains are accelerating.

We’ve been calling the “inflection point” for many months, and we can see that clearly illustrated when the trends reversed course in 2023. According to Trendraphix’s recently released (month-to-date) March data, there was a 23.4% year-over-year increase in pending sales in the four-county (King, Snohomish, Pierce, and Kitsap County) region. The spring sales season has kicked off early this year, promising more activity and indicating pent-up demand.

Here’s a snapshot that closely matches how the S&P/Case-Shiller Home Price Index is measured for resales only of single-family homes in the four-county area (not new construction and not including condominiums or land):

“U.S. home prices faced significant headwinds in the fourth quarter of 2023,” says Brian D. Luke, Head of Commodities, Real & Digital Assets at S&P Dow Jones Indices. “However, on a seasonally adjusted basis, the S&P Case-Shiller Home Price Indices continued its streak of seven consecutive record highs in 2023. Ten of 20 markets beat prior records, with San Diego registering an 8.9% gain and Las Vegas the fastest rising market in December, after accounting for seasonal impacts.”

The Seattle metro area finished 2023 with a modest 3% median home price increase, and the West Coast in general was a late bloomer to recover after witnessing some of the most significant declines in recent years, but, again, that followed the most significant gains during the pandemic. While this has been a yo-yo, it seems clear that waiting to buy will mean more competition and higher prices. In the four-county region in February 2024, there were 1.2 months of inventory, which is down 13.8% year over year. However, compared to January, which had 2,848 listings, the number of new listings was up in February with 3,840 listings. We do expect to see a surge of new listings this spring, but also more enthusiastic sellers testing higher prices.

In one example, RSIR experienced an Eastside view property this weekend that had more than 250 tours and received 9 competing offers before going under contract. This isn’t the only situation as open house traffic in popular areas is garnering scores of interested buyers. The lack of supply is being felt, and we know that new construction is far behind meeting the regional housing goals, so the imbalance is no doubt going to push prices higher.

Many homebuyers are observing the “buy then refi” (buy then refinance) strategy, and it’s clear that after prices reset to digest higher mortgage interest rates, we will witness a new cycle.

Again, we expect the inventory to increase substantially in the next few months but with higher pricing. As of February, the median sales price is $725,000 in the four-county region, showing price growth despite the cooler winter market.

We have migrated from “FOMI” (fear of mortgage interest) to “FOMO” (fear of missing out). Buyer demand likely hasn’t waned but rather waited. Just like historically low mortgage rates “pulled forward” future demand to make moves in 2020 to 2021, in 2022 to 2023 we saw demand “push back,” and now that recoil effect is playing out because most understand the temporary burden of higher mortgage rates falls well below the longer-term benefit of a sharper purchase price. With home prices rising at 3% or more, that goes a long way to compensating for higher rates.

This blog originally appeared on rsir.com.